COVID-19 has accelerated digital transformation, no longer a question. Projects that since before the pandemic were adapting to the new environment will be able to survive, while those that show resistance to change, both before and now, will be falling further and further behind, relying on the desire to maintain old models, with black glasses so as not to see danger signs of extinction. Once again the old story of the survival of the species in an increasingly competitive and violent media ecosystem. The media needs leaders who think and interpret the future of the media and less support for the decadent way of doing things.

We live surrounded by information saturation, where polarization is observed and in networks and platforms there is more disinformation every day; in this context, journalists are more necessary than ever. The journalistic professional chooses the information between the noise, knows how to tell what is important and put it in context, so that what is happening is understood as best as possible on the other side.

To complete this chronicle of the international media ecosystem, the digital media and information media will be addressed first, and then the possible avenues for the future of journalism. Once data and situations from different countries are known, the evolution of streaming platforms will be analyzed to reflect on what will happen with the changes that COVID-19 has made on the table.

Digital and news media, eight trends marked by 2021

According to Rasmus Nielsen, director of the Reuters Digital News Report 2021 Institute of Reuters, “This year’s results reveal that the coronavirus pandemic has accentuated many of the long-term trends we have documented over the past decade, especially its more digital character, the hegemony of the mobile phone, and the establishment of a media environment dominated by traditional media platforms,” as well as “this year’s importance has been discussed.

In addition, the analysis shows how the role of platforms is being modified. The roles of major organizations, journalists and other social media voices have been documented, a growing passage of people to closed messaging applications and visual social networks has been detected, and a constant public concern has been observed for false or misleading information -especially in public messaging applications such as Facebook and Whatsapp.

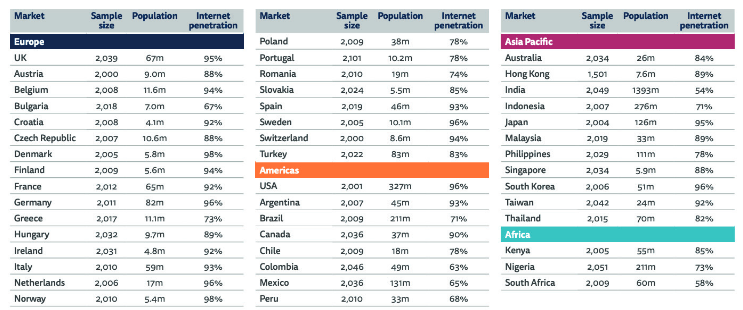

The work covers 46 international markets, more than half of the world"s population: 24 countries in Europe; 11 in Asia (including India, Indonesia and Thailand in the 10th edition of the 2021 study); eight in the American continent (USA, Canada and six countries in the Latin American market — adding Colombia and Peru in the last year —; and three in Africa (Nigeria for the first time since Kenya 2020 and South Africa since 2019). To carry out the research, an on-line questionnaire was used and the responses were collected at the end of January and beginning of February 2021. Focusing on the web survey, the samples mainly represent the online population, a group that practically coincides with the reality in countries with high internet access, but this is not the case in places where network penetration is lower.

(images: Reuters Institute)

The list of selected markets therefore presents gaps, both in countries and in the digital divide. However, the annual report produced by the Institute Reuters in the last decade is an ideal starting point and arrival point to learn about the avatars of international digital behaviors.

The most reliable brands grow also online

Trustworthy organizations, whether brand or public, have gained greater online reach, accumulating the relevant online audience increments, that is, people have more satisfied the informative appetite for coronavirus on the portals they previously trusted, and due to previous knowledge and confidence, the digital growth of these brands has been higher. Although the numbers vary by market, the online growth of less reliable media has not been as good as the growth of others in general.

The study focuses on a media ecosystem strongly influenced by COVID-19 (both by the time of data collection and the media presence of the virus in early 2021). On average, the level of general interest in news has not increased in the last year (59% of the population shows interest in information), coronavirus, news repeatability, confusion or depressive effect of data are cited as reasons for reduction. However, interest in news has increased in countries most affected by the coronavirus crisis, with a higher increase among groups affected by the virus (61%), among those over 35 (63%) and higher levels of education (67%).

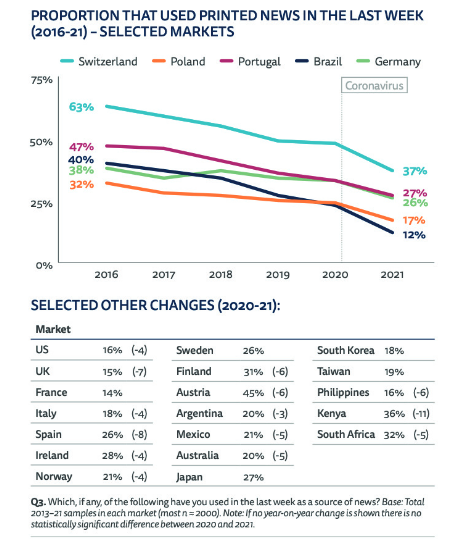

Paper decline

COVID-19 has had a major influence on the decline in printed publications, such as restrictions on the free mobility of citizens, the decrease in advertising and, to a lesser extent, the responsibility for contamination caused by printed copies. The largest degenerations are observed in markets traditionally dominated by the paper press, such as Germany, Austria and Switzerland.

The crisis has had an enormous impact on the free press at international level, especially in these publications distributed to travellers on public transport. Thus, the influence of the coronavirus is sculpting the industry and accelerating the plans for digital transformation and work organization. Interrupted temporary employment, dismissal and closure have also led to a decrease in the information capacity in times of a strong need for information to the population.

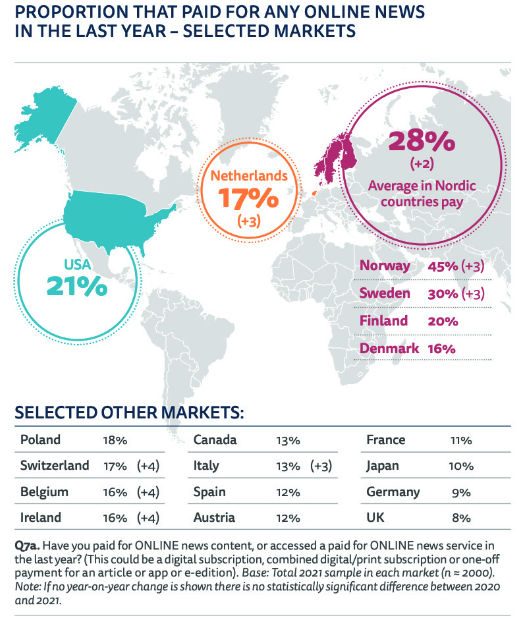

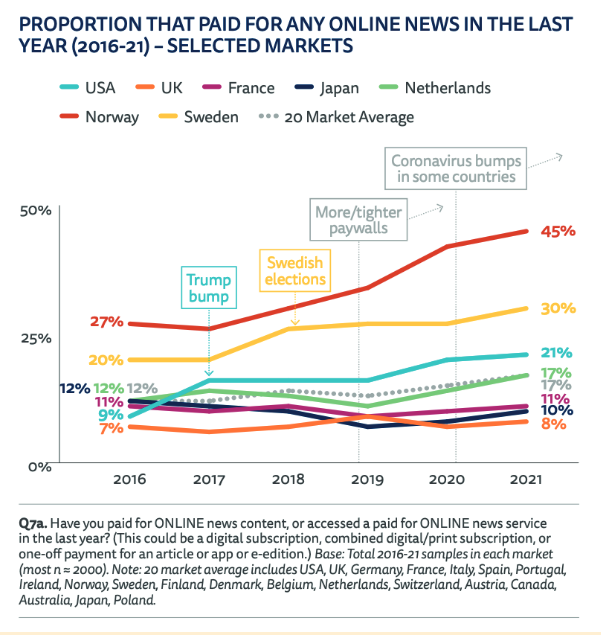

Payment for news

In 2021 there have been many news items hidden behind the payment walls and, therefore, the media – both traditional and creative – that have opted for payment strategies. They have opted for subscriptions, partners or donations in order to reduce their dependence on advertising (especially Google and Facebook are network advertisers), but the evolution is slow, as the vast majority of users do not intend to pay for online news.

There are countries that accumulate a little more success in the growth of digital subscriptions, prosperous markets and that historically have a high rate of paper press subscription, such as Norway (45% of the population grows +3 since the previous year), Sweden (30, +3%), Switzerland (17, +4%) and the Netherlands (17, +3%). Conversely, in the USA, one in five citizens currently pay for digital communication (21%), similar figures in Finland (20%) or Australia (13%), far from Germany (9%) or the UK (8%).

In the growth they have had a lot to do with the elections of different countries, the increase and narrowing of the payment walls, or the quality journalistic elections in some places by the coronavirus.

Similarly, in the Nordic countries (such as Norway, Sweden or Finland) the local media subscription rate is high, i.e. many subscribers claim to be subscribed to the local media, which is the cause of the subscription consumption data of these countries.

Based on sociodemographic data, digital media subscribers are generally high income, higher education and aged between 40 and 55.

In addition, the average user subscribes to a single media in general, and the tendency to make a second subscription among those who subscribe to several markets begins to manifest itself: the average is already two subscriptions in the USA. and the second is often the subscription to a local media, or even there are those who mention the possibility of paying a particular journalist (in exchange for the newsletter via Substantiack or the creators of Youtube). In other words, for a growing American minority it is common to combine subscription to a national publication with a local media, or specialist.

Subscriptions have therefore started to work, for some institutions, but it is not clear whether they will serve all consumers. Most people do not have enough interest in the news or do not have money to put the news above other areas of their lives. Others will practice resistance because, keeping the network free, they can choose from many sources and do not want to limit themselves to one or two publications.

Subsidizing the future of the media?

Although many publishers, politicians and academics are concerned about the future of the media, the Reuters report suggests that most ordinary people do not agree with those concerns. In all countries of the study, only one third of the population (31%) realize that many commercial media were more profitable than ten years ago, and the majority (53%) are not concerned about this issue. Similarly, only a quarter of respondents (27 per cent) would support government intervention in the commercial media — three out of ten (29 per cent) have no opinion on this.

Some governments, following the coronavirus crisis, have offered temporary aid to publishers through licensing, revenue or tax relief, but it is not clear whether there is currently sufficient public support for deeper and longer interventions. Given the low level of public awareness of the challenges facing the news business and the low level of support for possible government intervention, as well as the low level of reliability of news in many countries, it is not clear that it is politically attractive to prioritize journalism at the expense of other priorities of greater awareness and public protection such as health or education.

Increased trust and extreme reliability

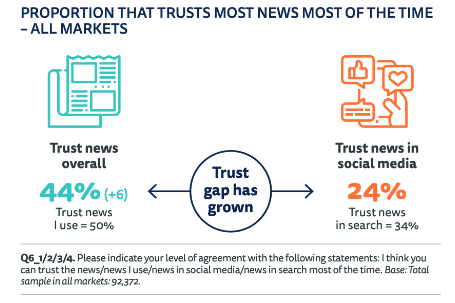

Confidence in the average news has grown by six points in one year, the overall reliability rate is 44% (somewhat lower in Spain and France with 36% and 30% respectively) and reliability with the chosen news by each has increased to 50%. This growth linked to the media, on the other hand, has not occurred on social networks, so this year’s trust between the media and social networks is greater, 24% of the population is reliable to social media news.

In addition, according to international average numbers, four out of ten respondents aged 18 to 24 (40%) say that their main sources are social networks, and it is precisely this group of people who feel unrepresented in the media with the greatest strength — they find nothing of their interest and do not connect the press with them either.

According to the rapporteurs, this higher degree of confidence in the news, and especially in the sources of free choice, may be linked to the broad coverage of the coronavirus as a legal source of guarantee.

While in some international countries there are very few who manifest lack of confidence in the news, in others there are more who disagree with the statement that most news is reliable. In the United States, for example, the perception of credibility has a deficit of 15 points: 44% of Americans are mistrusted by the news and 29% are confident — politically right-wing people are more likely to be suspicious. The deficit is also noted in other countries, such as Bulgaria (12 points), France (-8), Hungary (-6), Chile (-4) and Argentina (-3), while in Denmark the trust group increases 48 points.

Social networks: growth and growth of messaging applications

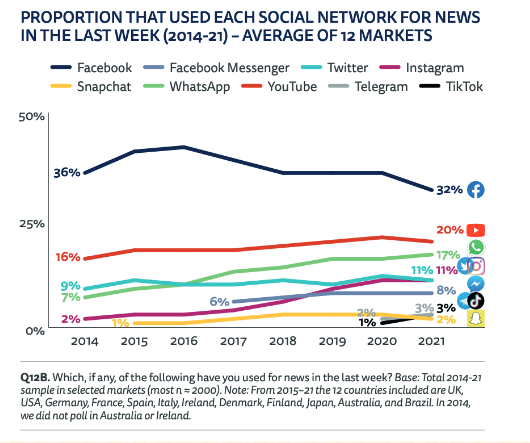

Since 2014, 12 countries have asked about their use of social networks for any purpose, or specifically for news. In the category of any target, the order of the most used networks in 2021 has been as follows: Youtube (62%), Facebook (61%), Whatsapp (52%), Instagram (39%), Facebook Messenger (36%), Twitter (22%), Snapchat (13%), Tik Tok (12%) and Telegram (10%).

In these 12 countries, two-thirds of the population (66%) uses a social network or more than one messaging app to consume, share or debate news. However, the combination of information networks used has changed substantially over time: Facebook has not been so important in the last year, while Whatsapp, Instagram, Tik Tok and Telegram have attracted more for the use of news.

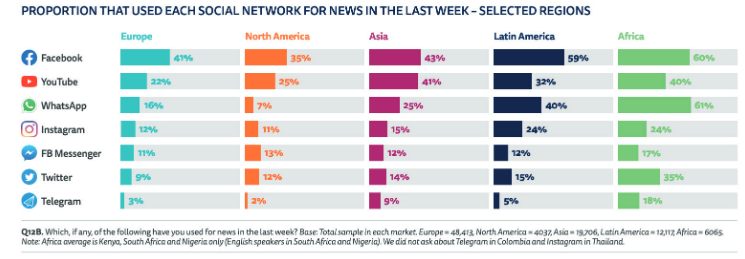

In addition, the same use is not made in the world: In Asia there is more trust in the Youtube platform, while in Latin America and Africa more attention is paid to the Whatsapp and Instagram networks. In the last year, the use of Telegram has doubled — along with the change taking place in the most private networks — in some countries: Nigerians using Telegram for news accounts for 23%, Malaysians 20% and Indonesians 18%.

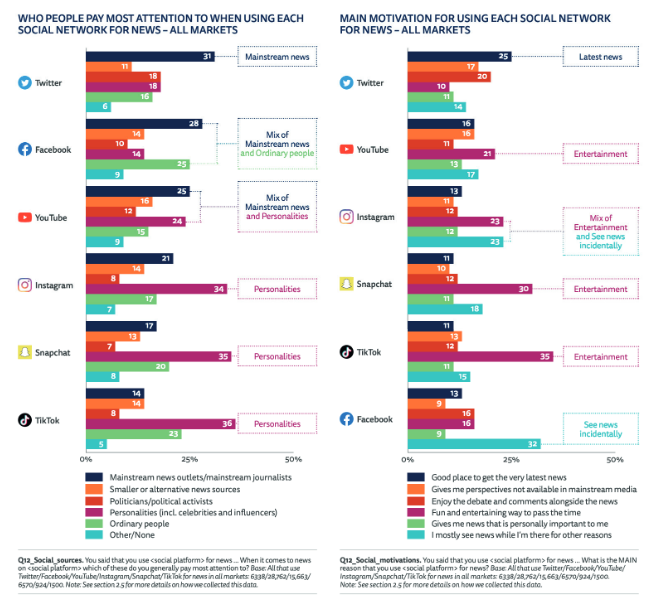

There are two other interesting questions that have been specifically addressed to those who have pointed out that they use news networks. On the one hand, it pays more attention (major media or journalists, smaller or alternative sources of information, politicians/political activists, celebrities — including pradebrites and influenarines — or ordinary people). On the other hand, what is the main reason why these social networks are used for news (good place to receive the last minute ones, to receive views that are not found in the mainstream media, to lament the debate and comments that have emerged about the news, to spend time in a fun and entertaining way, to give news of personal relevance or to see news on those networks while they are present for other reasons).

The majority of media and journalists’ attention is seen among citizens using Twitter (31%) and Facebook (28%) networks for news. In addition, there is a growing presence of ordinary people – legal sources on the various social networks in general and on some networks (Instagram, Snapchat or Tik Tok) a great deal of attention – even when it comes to news consumption.

Depending on the motivations, the responses vary by network: Twitter is considered a good site to receive and discuss the latest news, but users receive the news while browsing for other reasons on Facebook. Instagram, Snapchat and Tik Tok are a place of fun and entertainment, and on Youtube the argument for choosing one or the other appears more distributed.

In this sense, the most recent social networks, created and disseminated to youth, pose an important challenge for the media. Journalists and redactions focused on more traditional formats do not reach the desire to make curious, visual and entertaining news, and have analyzed that, despite the experiments being done here and there, filling those networks with adequate, important and attractive content, and taking advantage of the support to the media is a task still underway and yet to be done.

Consumption of information through social networks

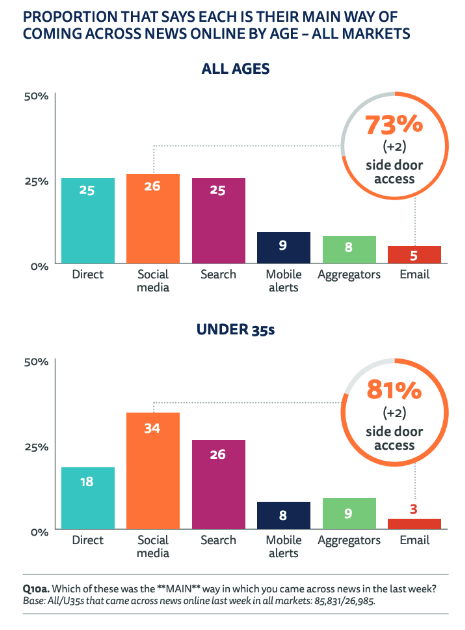

Asked what has been the main means of receiving news in the last week, social networks and network seekers are becoming standards. Online information consumption habits are increasingly focused on the presumed “younger patterns” in all age groups, although the choice of social networks or search engines is even more evident among those under 35.

In all countries, only a quarter of the population (25%) prefers to start their journey through a website or application – an option that is reduced by three points compared to the previous year and by seven points compared to it. In this sense, children under the age of 35 show greater disengagement with websites and applications (18%) and have much greater access to news through social networks (34%).

One of the conclusions is clear: most people choose non-media spaces and routes for online consumption (75% of third-way digital news consumption compared to 82% of those under 35). Being aware of this phenomenon is important because it seems that people are not going to leave platforms and aggregators, as they have become accustomed to receiving information quickly and this way. In this sense, the issue is how the media deal with external platforms, in most cases the media provide content and audience platforms and their rules. The media believe that this approach is untenable and that better conditions are being demanded of both platforms and governments.

Another trend to keep in mind is that 73% of the population access news via mobile (69% in the 2020 study). Mobile phones have been imposed on computers in almost all countries and computer news consumption has dropped by three points (49% in 2020 versus 46% in 2021).

Podcasts and audio boom

Podcasts have become everyday and although the number of consumers appears to have not increased (31% of respondents have entered a podcast in the last month, as in the previous year), they are successful in Ireland (41%), Spain (38%), Sweden (37%), Norway (37%) and the United States (37%). Podcast fans are less frequent in the Netherlands (28%) – below average – as in Germany (25%) and the United Kingdom (22%).

Spotify, Amazon and Google have been investing in podcasts in recent years, seeking to capitalize on the growing demand that exists and break Apple"s leadership. We have also seen the Spotify video option added to your app. The rise of podcast videos, based on instruments such as the Zoom deployed throughout the pandemic, comes to the staging of new possibilities of expansion and to delve into the problem of researchers defining what a podcast is. In this scenario, the Apple Service has been imposed in some markets on Spotify, in others on Youtube, and public media plays an important role in a few countries.

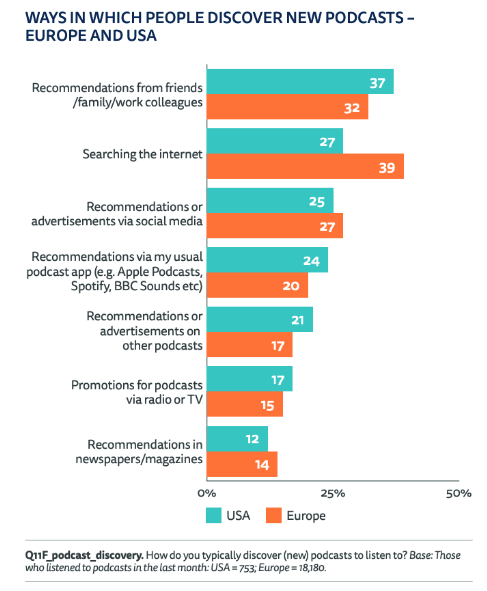

In recent years there has been an explosion in the generation of podcasts, but the study reveals that demand has not grown at the same pace, so the main problems are the discovery and knowledge of the contents that spread through it. According to the data, in Europe and the United States, more people find podcast programs through recommendations from friends, family or acquaintances than through application or advertising recommendations. The search is also important, particularly in Europe, but the initial link is often derived from a personal recommendation. Promotion through applications such as Apple Podcasts, BBC Sounds, or promotion through television and radio mentions, or newspaper articles, are important for some.

The commercialization of content of increasing quality implies that the audio programming of the platforms reaches a wider and more central audience, and the movement is generating new questions for the public institutions of the radio. According to respondents in the Digital News Report 2021 study, many believe that platforms will assume an important part of the credit/attribution of public content and that they will increasingly have control over access and content search, as it happens with social networks, under external algorithms.

Seven possible avenues for future journalism

Eight out of ten journalists and editors plan to advance subscription or body strategies by 2022. This is one of the effects of Journalism, Media, and Technology Trends and Predictions 2022, by the Reuters Institute. This survey analysis has been answered by journalists, editors and media directors from 52 countries and territories of the world, with a total of 246 contributions.

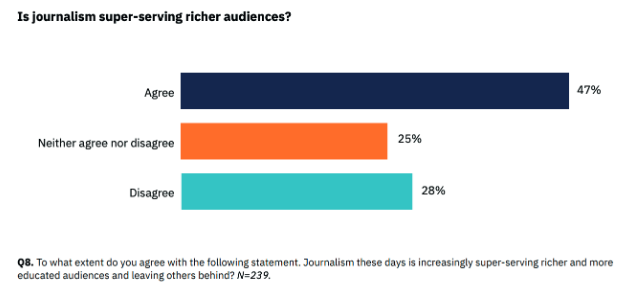

Most journalists say that one of their priorities will be to advance with subscriptions. However, 47% believe that body models favor journalism that pays too much attention to the richest and most educated audiences, leaving behind the rest of the population, as the media have detected that those who become subscribers are people of a very high socioeconomic profile interested in public affairs. The installation of payment walls is a reasonable method of journalistic funding, but it imposes cracks on the hearings.

However, in an attempt to reduce this hole, the study underscores that 2022 will bring more deals to those with less purchasing power: ‘Daily Maverick, from South Africa, offers the possibility to subscribe to ‘pay what you can pay’, the Spanish project elEntor.es offers the possibility of not paying anything to people who meet a number of requirements, while in Portugal the lottery funding has been used to finance 20,000 free digital news subscriptions for eight media (…) Others, such as the Danish organisations, open free educational programmes.’

Increasing revenue fosters confidence

Three out of four journalists (75%), editors, media directors and digital leaders are hopeful, reliable and confident about the future of their media. This is a consequence of the increase in media revenue, as six out of ten journalists say revenue increased in 2021, despite the decline in digital news consumption.

However, this confidence drops to 60% when asked about the future of journalism. The problem is the political polarisation of society, attacks on journalists and the financial stability of the media.

Diversification

On average, the media will seek three or four sources of revenue by 2022. Having 30% of study participants is the group that expects to get benefits through technology platforms for innovation or innovation licenses, 15% is the group that says it will seek donations and others hope to restart the events that have been left by the COVID-19 crisis.

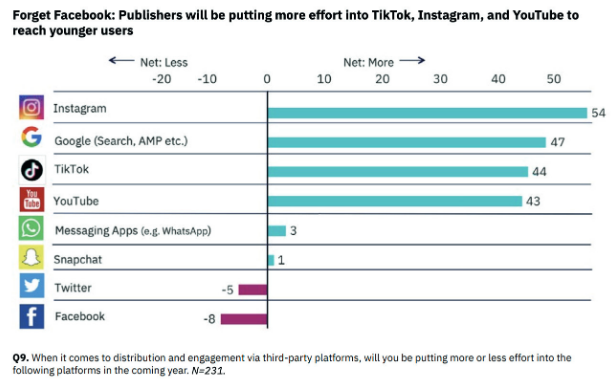

Less Facebook and Twitter, more Tik Tok and Instagram

The editors claim that this year they will devote less attention to Facebook and Twitter, while efforts on social networks will be made on Instagram, Tik Tok and Youtube platforms, which are precisely the platforms that are accumulating most successfully among young people.

No major developments expected

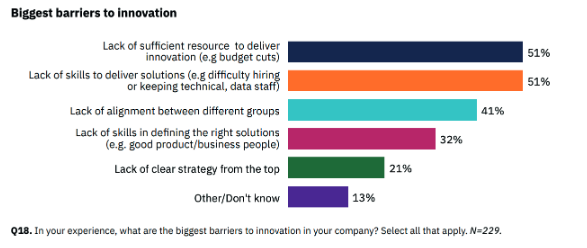

It"s a back to basics, according to the Reuters Institute. Two-thirds of the interviewees said they will focus their efforts on improving existing products by 2022, rather than keeping them in the new product market. Likewise, the editors consider that the lack of economic resources and the difficulty to retain and attract talent are the main obstacles to innovation.

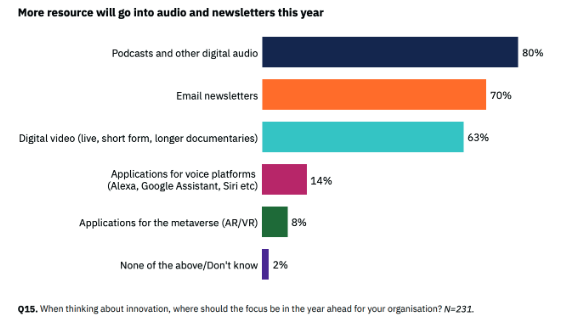

More podcast

The podcast has come to stay and the editors will invest more resources in this format over the coming months. Therefore, on the road to digitalisation and innovation we will receive more podcast offers and a broader newsletter offer – as both formats have proven their value to increase their loyalty and attract new subscribers – and digital video will not be left behind (direct, short videos, longer documentaries).

Virtual actions

More or less surprised by the audience will close their offices more and more media outlets. The industry is moving towards completely virtual redactions, or we"ll see more cases by 2022, and this trend is not bad news in all cases. The fact is that, even in the office, work is increasingly virtual for everyone, a routine that has been accentuated by the teleworking of some journalists and the redactions of others.

In this regard, in the UK, editor Reach, owner of nine English media, 110 newspapers and 80 digital brands, has closed 75% of the offices and put employees on teleworking, while Archant will close two thirds of its offices by March 2022, saying that workers prefer to work from home. It is also planned to expand the attempts to rethink offices as spaces for community events, combining the proximity of live performances with the participation of large online sessions.

Export formats are increasingly needed

Exhibition formats are increasingly needed when the Internet is full of news produced for experts, as it is usual to find a lot of news from the same phenomenon, but none of them is easily understandable and simple. Audiences want to understand this fast-growing world they live in, why their friends talk about certain events and, to do so, explainers are a good way to consume brief, attractive and simple information.

COVID-19 intensifies this need and display formats become viral hit on social networks, especially when presented in video.

Stabilisation of streaming platforms, a new normal

In the era of the pandemic, streaming consumption rose dramatically, above the expected upward trends, in full acceleration. Global streaming consumption now appears to be stabilising in the light of the 2021 numbers. According to the analysis company Conviva, and taking into account what their Conviva’s State of Streaming says, the profit is maintained during the pandemic and a new normal entertainment model appears to have stabilized.

Data are obtained using technology patented by them: They track 4 billion video streaming apps, generally following the fingerprint of over 500 million viewers, who see 200 billion remissions annually. Integrating sensor tracking into video streaming applications, each day they measure three trillion real-time transactions in over 180 countries, focusing on content and ads.

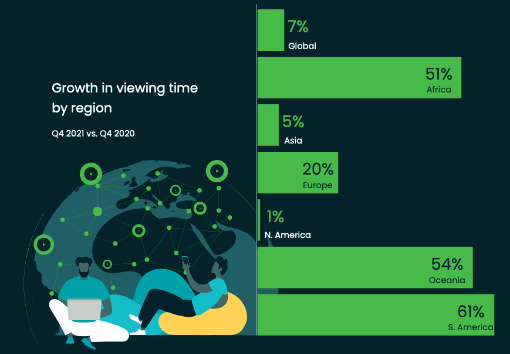

According to these data, the overall viewing time of streaming services increased by 7% in the last quarter of 2021, compared to the previous year, and in the following quarters, Conviva’s ones hope to continue growing slowly but continuously.

The report at the end of 2021 highlights four trends/facts:

- The screen remains in the first position as a global audience of 4 levels of streaming consumption that concentrate more than 50% in all areas, except in Asia, where, at the moment, consumption via large screens grows rapidly, but it remains, unlike elsewhere, mobile the main consumer (40%).

- For the first time, the viewing time of streaming consumption via connected televisions has decreased, while among device manufacturers only Roku has grown, with Apple TV and Amazon Fire Tv 1% and 7% respectively.

- Overall, video quality has improved. However, there is a great exception, the starting time. The video start time exceeded five seconds by the end of 2021, and the advertising start time also increased considerably to 2.6 seconds, both due to technical problems.

- It seems that Youtube Shorts is on the rise, shorter format content increased by more than 2% last year on the platform known in the traditional edition for longer format videos. In the last quarter of 2020, 90.3% of YouTube videos exceeded one minute, compared to 87.9% in the last quarter of 2021. The way content is produced is changing slightly and more and more Tik Tok short videos are seen everywhere.

General trends and data, but there are points that deserve a little more concreteness, such as the increase in the viewing time of streaming platforms, which, as mentioned, in the last quarter of 2021 the average international increase has been 7%, but not regular in all areas of the world.

South America (61 per cent), Oceania (54 per cent), Africa (51 per cent) and Europe (20 per cent) have experienced two-digit growth because in some cases the habit of this type of consumption is increasing and in others, although these are more consolidated markets, where there is still room for growth. In Asia, the viewing time of streaming applications has increased by only 5%, while in North America, one of the most consolidated streaming markets, 1%, is also a more saturated market in which the slowdown is situated.

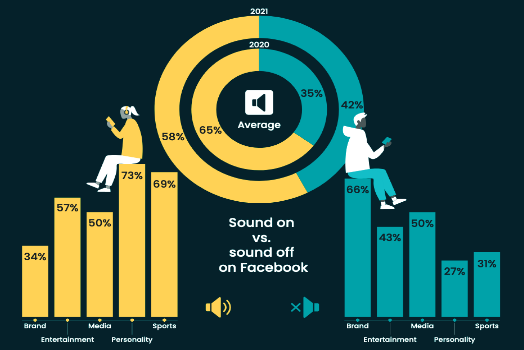

Another phenomenon that is becoming increasingly important in the field of video streaming is that of subtitles. The analysis company Conviva has also looked at social media movies6, where we have seen how we see videos: we see more and more unembedded videos on Facebook, 42% in 2021 (35% in 2020). This trend tells us that the importance of subtitles of videos is increasing and will be (both the verbal subtitles of what is said, and the videos created specifically to understand without sound, with the overprinted story on the screen).

This change is also important from a sectoral point of view: the videos associated with the brand are the ones that have the best chance of seeing the sound faded (as seen in 66% of the videos), and the media take second place, representing half of the videos (this silent consumption is sometimes a widespread practice in the consumption of social networks). The duration of videos is also significant: 17% of those from 0 to 10 seconds without sound, 36% of those from 10 to 30 seconds and 49% of those from 30 to 60 seconds (hence the practice of sharing videos decreases slightly: 45% of videos from 60 seconds to 5 minutes and 33% of videos over 5 minutes). It should therefore be borne in mind that without the use of subtitles on social networks, many people will not access all the videos.

What about the changes that COVID-19 has made on the table?

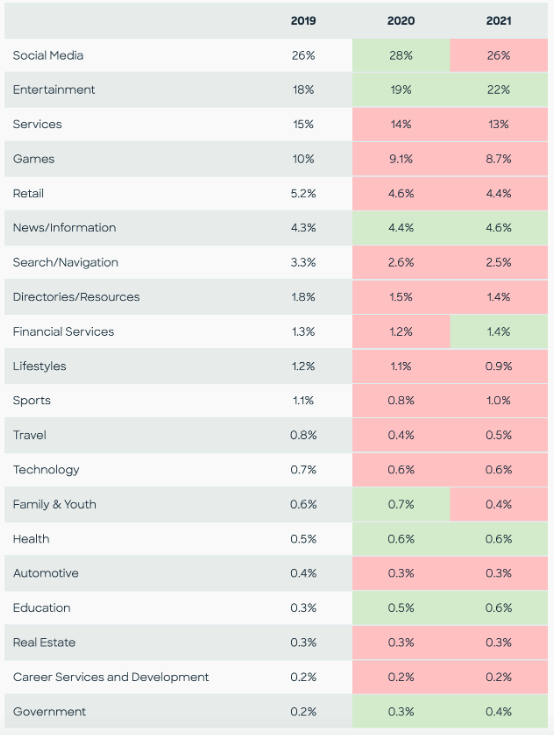

There"s a big hobby, and more when there are so many changes on the table, to guess what the future means. It almost never invents itself, but trying is a reflection of the concerns, needs and desires of the past. The agency Comscore has conducted a trial to analyze its online behaviors based on audience data and categories in which citizens from France, Germany, Italy, Spain and the United Kingdom spent online time between 2019 and 2021. The starting question is whether consumers will return to pre-pandemic customs or the changes that have taken place will encourage the stabilisation of a new balance? In order to respond, users have observed an increase and/or decrease in the time spent in certain online categories.

Only a few categories have increased their share over time since 2019. They are: entertainment, news/information, financial services, health, education and government. In both categories, social networks and family and youth, their proportion of time increased in 2020 and then decreased in 2021. In the rest of the categories the time spent online has decreased.

In general, the data shows that online entertainment is the big winner. It is also beneficial for the media to know that users spend a little more time on news and information in general than before the pandemic – despite the fact that more and more news and information users consume on platforms that are not the media – maintenance and a slight increase in this attention (from 4.3% in 2019 to 4.6% in 2021) is an important factor in transformed cyberspace.

1 Reuters Institute (2021): Digital News Report 2021, <https://reuters .politics ox.ac.uk/sites/default/files/2021-06/Digital_News Report_2021_FINAL.pdf> <https://reuters .politics ox.ac.uk/sites/default/files/2021-06/Digital_News Report_2021_FINAL.pdf>.

2 Newman, Nic (2022): Journalism, Media, and Technology Trends and Predictions 2022, Reuters <https://reutersinstitute.politics.ox.ac.uk/sites/default/files/2022-01/Newman%20-%20Trends%20 and%20Predictions%202022%20FINAL.pdf > <https://reutersxliff-newline .polit> Institute, <https://reutersinstitute.ox.ac.uk/sites/default/files/2022-01/Newman%20-%20Trends%20 and%20Predictions%202022%20FINAL.pdf > <https://reutersxliff-newline%20Trends.

3 Coexistence (2022): Conviva’s State of Streaming Q4 2021, <https://www.conviva* <https://www.conviva* com/state-of-streaming/convivas-state-of-of-streaming-q4-2021/> com/state-of-streaming/co-state-of-of-of-the-art -q4-2021/>.

4 The term “big screen” has been associated with cinema for many years, but the expansion of streaming platforms and the multiplication of screens we use in our daily lives also implies a re-dimension of the concept: nowadays, computer or television screens are considered big screens.

5 These are short videos, in Tik Tok or Instagram Reels style, vertical experiences, which are the format offered by Youtube in the face of the ascending tendencies of both, or what is the same, the replica that the public does not go to other networks.

6 They have access to 2,963 social media analytics accounts on Facebook, Instagram, Twitter and Youtube platforms, and in the last quarter of 2021 they analyzed over 1.8 million posts and 10,000 million engagement.

7 Gevers, Alex (2022): Online behaviours and what to denounce, in 2022 as the world reverts into normalcy, <https://www.comscore.com/Insights/Blog/Online -behaviours-and-what-to-expect-as-the-the--reverts-formular-funcionalcy> <https://www.comscore.com/Insights/Blog/Online -template-and-what-to-expec-as-the---reverts-funcalcy>.